What is bonus shares

தினமும் வீட்டில் இருந்து பணம் சம்பாதியுங்கள்

சென்னையில் குறைந்த கட்டணத்தில் பங்கு சந்தை பயிற்சி

SHARE MARKET TRAINING

BCOM COACHING CLASS - 9944811555

Whatapp Number : 91-9094047040 / 91-9841986753

இப்பொழுதே இங்கே பதிவு செய்யுங்கள்

சென்னையில் குறைந்த கட்டணத்தில் பங்கு சந்தை பயிற்சி

What is bonus shares

Bonus shares are additional shares given to the current shareholders without any additional cost, based upon the number of shares that a shareholder owns. These are company's accumulated earnings which are not given out in the form of dividends, but are converted into free shares.

Who is eligible for bonus shares?

Bonus shares are usually announced by the company with a record date, the date which is considered for the bonus shares. All the investors holding the shares on the record date are eligible for bonus shares. Company usually gives bonus shares as a substitute of dividend payouts

How is bonus share calculated?

The company issued one Bonus Share for every five shares held by the Equity Shareholders. You are asked to compute the value of each Equity Share before and after the issue of Bonus shares of the company.

Why do companies issue bonus shares?

Companies low on cash may issue bonus shares rather than cash dividends as a method of providing income to shareholders. Because issuing bonus shares increases the issued share capital of the company, the company is perceived as being bigger than it really is, making it more attractive to investors.

What is difference between bonus share and split?

Here is the difference. Bonus shares are issued by capitalising the free reserves of the company. The share capital of the company increases. ... If the company issues stock split say face value of 10 is reduced to 5, share captal of the company remains same, no of outstanding shares double.

What happens to share price when bonus shares are issued?

When bonus shares are issued there is a proportionate fall in the price per share but the value of the firm or entire holding remains same. ... Theoretically, the stock price should also decrease proportionately to the number of new shares. But, in reality, it may not happen.

Is bonus shares good?

If in the following year, the company increases its earnings and maintains the earning per share at levels estimated by the management, the stock will give good returns." ... The most common reason for issuing bonus shares is that the share price has become high and is affecting demand

Can we sell bonus shares?

Shares bought or sold after this date are traded ex-bonus. Typically, when shares become ex-bonus, their price falls in the ratio in which bonus shares are issued. However, there is a gap of four to six weeks before the shareholders actually receive their bonus shares. It is only then that the shares can be sold.

How can I get bonus shares?

Bonus shares are shares given to existing stockholders in proportion to the number of shares they hold. A 1:1 bonus means that a shareholder will get one share for each share held by him. For example, if someone is holding 10 shares, he will get 10 more. The shareholders do not pay anything for these shares.

Can I buy shares on ex bonus date?

This is because there are many shareholders who buy and sell the shares. ... Thus the shares before the record date are cum-bonus, which means bonus is included. Shares will be cum-bonus between 'Company declaring the bonus' and 'Record date'. Ex-bonus: It simply means without bonus.

What are the guidelines for the issue of bonus shares?

SEBI guidelines on bonus issue of a company are as follows:

No bonus shares shall dilute other issues: ...

Bonus issue from free reserves: ...

Revaluation reserve not eligible: ...

Issue in lieu of dividend: ...

Partly paid shares not eligible: ...

No default of payment of interest, etc.: ...

Time within which bonus issue shall be made:

What are the benefits of bonus shares?

In short, the number of shares issued by the company goes up but its net worth remains the same. Further, by the issue of bonus shares, there will be no cash outflow for the company. Shareholders who prefer dividend rather than capital appreciation also benefit from bonus shares via home-made dividend.

How are bonus shares issued?

Issuing bonus shares does not involve cash-flow. It increases the share capital of the company but not its net assets. Bonus shares are issued to each shareholder according to their stake in the company.

What is the difference between bonus issue and stock dividend?

Stock dividend is a bonus issue, allotted by the company to reward the shareholders. and The bonus shares are free shares that the shareholders receive against shares that they currently hold. These are issued out of the reserves of the company. ... Stock Dividend is also known as Bonus shares.

What is a stock bonus?

A stock bonus plan is a type of retirement plan designed to increase employees' vested interest in a company's success. A stock bonus plan is a type of profit-sharing plan paid in employer stock instead of cash.

What is face value of a share?

Face value is the nominal value or dollar value of a security stated by the issuer. For stocks, it is the original cost of the stock shown on the certificate. For bonds, it is the amount paid to the holder at maturity, generally $1,000. It is also known as "par value" or simply "par."

Can bonus shares be issued to preference shareholders?

The Act does not state any provision restricting or prohibiting bonus to preference shareholders. Further it does not expressly states that bonus shares can be issued "only" to equity shareholders. Hence, bonus shares can be issued to preference shareholders.

What is a bonus issue of shares?

An issue of bonus shares is referred to as a bonus share issue or bonus issue. A bonus issue is usually based upon the number of shares that shareholders already own. ... Although the total number of issued shares increases, the ratio of number of shares held by each shareholder remains constant.

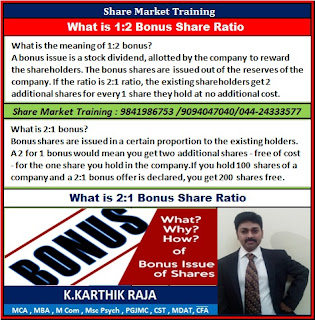

What is 2 1 bonus?

Bonus shares are issued in a certain proportion to the existing holders. A 2 for 1 bonus would mean you get two additional shares — free of cost — for the one share you hold in the company.If you hold 100 shares of a company and a 2:1 bonus offer is declared, you get 200 shares free

How long does it take to credit bonus shares?

Since existing shareholders do not see the bonus shares being credited to their demat account immediately after the price of shares have turned ex-bonus, there is generally a panic. It takes a maximum of two-three days for the shares to appear in your demat account

What is the meaning of 1 2 bonus?

A bonus issue is a stock dividend, allotted by the company to reward the shareholders. The bonus shares are issued out of the reserves of the company. ... If the ratio is 2:1 ratio, the existing shareholders get 2 additional shares for every 1 share they hold at no additional cost.

What is the meaning of bonus shares?

Definition: Bonus shares are additional shares given to the current shareholders without any additional cost, based upon the number of shares that a shareholder owns. These are company's accumulated earnings which are not given out in the form of dividends, but are converted into free shares

Are bonus shares taxable?

Capital Gains Tax on Sale of Bonus Shares. Bonus Shares are shares which are allotted for free to the shareholders and the shareholders don't have to pay anything for purchasing these shares. Bonus Shares are usually issued in proportions

What is bonus tripping?

Bonus stripping is a term used to structure a transaction of purchase and sale of shares of a listed company, which generates short-term loss which is set off against some other capital gains

Can bonus shares be issued at premium?

Bonus shares are issued by companies to capitalise their revenue as well as capital reserves. In simple words a company issues bonus shares to its shareholders for free by utilising the reserves lying with the company. ... So in my opinion a company cannot issue bonus shares at premium.

What is the record date for bonus shares?

Definition of 'Record Date' Definition: The issuing company fixes a particular date when the investor must own shares in order to be eligible to participate in corporate events like receiving dividend, bonus shares etc.

What is the difference between ex bonus date and record date?

Ex-date is the date on which the seller, and not the buyer, of a stock will be entitled to a recently announced dividend, bonus or other corporate action. The ex-date is usually a business day prior to the record date, since T+2 trading cycle is followed for clearing and settlement of trades in India.

What is Record Date and Ex Bonus Date in stock market?

The record date is set by the board of directors of a corporation and refers to the date by which investors must be on the company's books in order to receive dividends for a particular stock.